Take Home Tax Calculator Australia

Salary calculator australia is updated with 2020 2021 ato tax rates but you can also calculate taxes for the previous year i e.

Take home tax calculator australia. Salary sacrifice calculator is the pre tax contribution one make from the take home salary to the super account which later helps in the retirement. Australia uses a pay as you go payg tax withholding system meaning that tax is deducted from an employee s salary at source. This calculator helps you to calculate the tax you owe on your taxable income. Superannuation study training loan medicare payg.

The average monthly net salary in australia is around 4 831 aud with a minimum income of 1 120 aud per month. This pre tax income helps to reduce the pay tax by reducing the taxable income. For the 2016 17 financial year the marginal tax rate for incomes over 180 000 includes the temporary budget repair levy of 2. Simply select the appropriate tax year you wish to include from the pay calculator menu when entering in your income details.

Income tax on your gross earnings. In most cases your employer will deduct the income tax from your wages and pay it to the ato. It is calculated by using two methods as a salary sacrifice contribution or as an after tax contribution. Medicare levy only if you are using medicare.

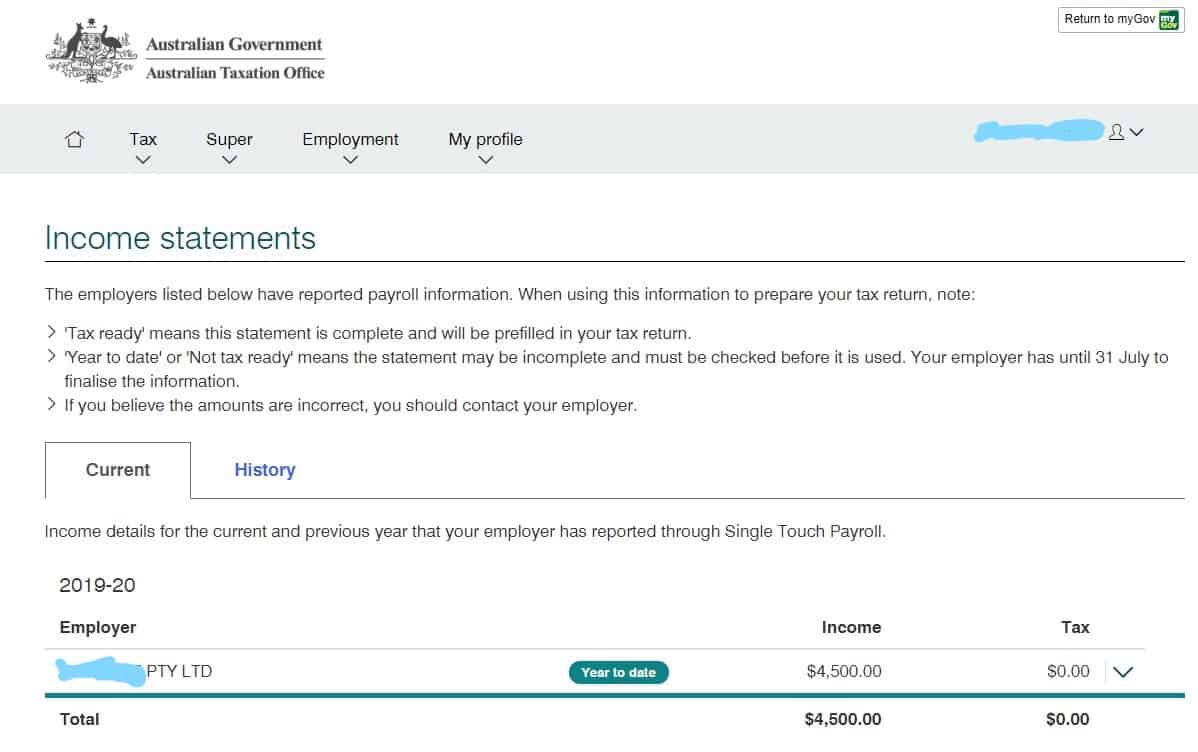

This calculator will display. Superannuation paid by your employer standard rate is 9 5 of your gross earnings. Simple tax calculator this link opens in a new window it will take between 2 and 10 minutes to use this calculator. The money pay calculator can be used to calculate taxable income and income tax for previous tax years currently from the 2015 2016 tax year to the most recent tax year 2019 2020.

Finally your take home pay after deducting income tax and medicare. It can be used for the 2013 14 to 2019 20 income years. Australia s best payg calculator. The 40k after tax take home pay illustration provides a salary calculation for an australian resident earning 40 000 00 per annum and assumes private medicare provisions have been made where necessary.

This places australia on the 15th place in the international labour organisation statistics for 2012. You can alter and edit this calculator to work out your out salary using our the salary calculator for australian income tax. The latest payg rates are available from the ato website in weekly fortnightly and monthly tax tables. Calculate your take home pay from hourly wage or salary.

Calculate salary for non residents. These calculations do not take into account any tax rebates or tax offsets you may be entitled to.