Take Home Salary Calculator California

Your job probably pays you either an hourly wage or an annual salary.

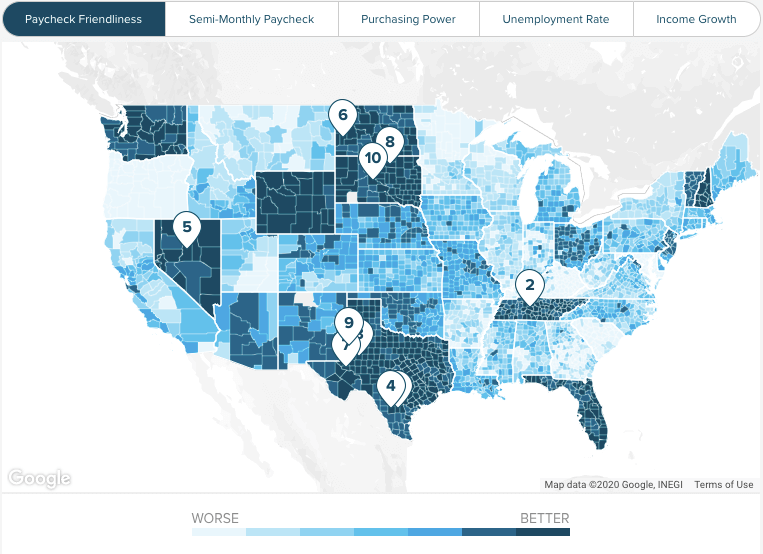

Take home salary calculator california. California salary paycheck calculator change state calculate your california net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local w4 information into this free california paycheck calculator. We ll do the math for you all you need to do is enter the applicable information on salary federal and state w 4s deductions and benefits. If you make 55 000 a year living in the region of california usa you will be taxed 11 394 that means that your net pay will be 43 606 per year or 3 634 per month. That s because your employer withholds taxes from each paycheck lowering your overall pay.

Use gusto s salary paycheck calculator to determine withholdings and calculate take home pay for your salaried employees in california. But calculating your weekly take home pay isn t a simple matter of multiplying your hourly wage by the number of hours you ll work each week or dividing your annual salary by 52. How your california paycheck works. Federal salary paycheck calculator or select state calculate your net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local w4 information into this free federal paycheck calculator.

The rules more than double the minimum salary threshold for employees to qualify as exempt from overtime from 23 660 a year to over 47 000.