Take Home Pay Calculator Nj

Calculates federal fica medicare and withholding taxes for all 50 states.

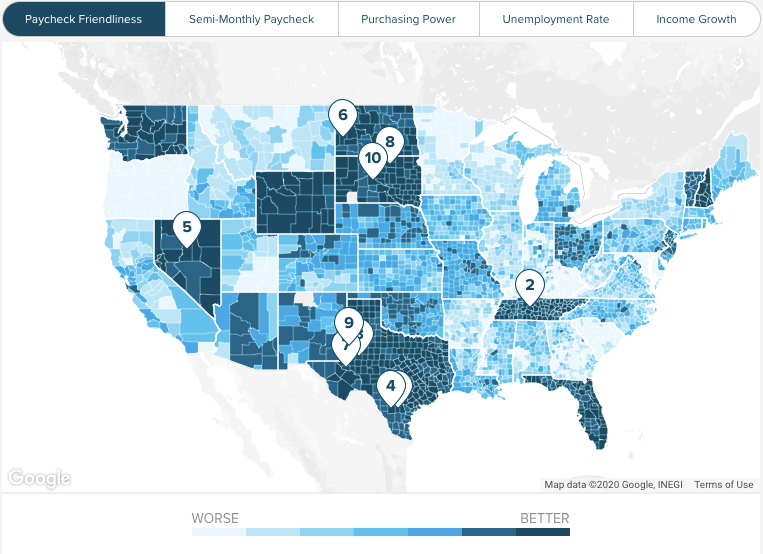

Take home pay calculator nj. Check out our new page tax change to find out how federal or state tax changes affect your take home pay. Overview of federal taxes when your employer calculates your take home pay it will withhold money for federal income taxes and two federal programs. New jersey paycheck calculator your details done use smartasset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more.

This new jersey hourly paycheck calculator is perfect for those who are paid on an hourly basis. The salary calculator tells you monthly take home or annual earnings considering uk tax national insurance and student loan. Supports hourly salary income and multiple pay frequencies. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local w4 information.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the u s. We ll do the math for you all you need to do is enter the applicable information on salary federal and state w 4s deductions and benefits. New jersey salary paycheck calculator. Why not find your dream salary too.

Use smartasset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculation state date. Use gusto s salary paycheck calculator to determine withholdings and calculate take home pay for your salaried employees in new jersey. Can be used by salary earners self employed or independent contractors.

Calculate your new jersey net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local w4 information into this free new jersey paycheck calculator. Overview of new york taxes new york state has a progressive income tax system with rates ranging from 4 to 8 82 depending on taxpayers income level and filing status. Use smartasset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Hourly rates weekly pay and bonuses are also catered for.

Federal salary paycheck calculator or select state calculate your net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local w4 information into this free federal paycheck calculator.