Stamp Duty Calculator Second Home

Stamp duty for second homes also attracts a 3 percent surcharge from april.

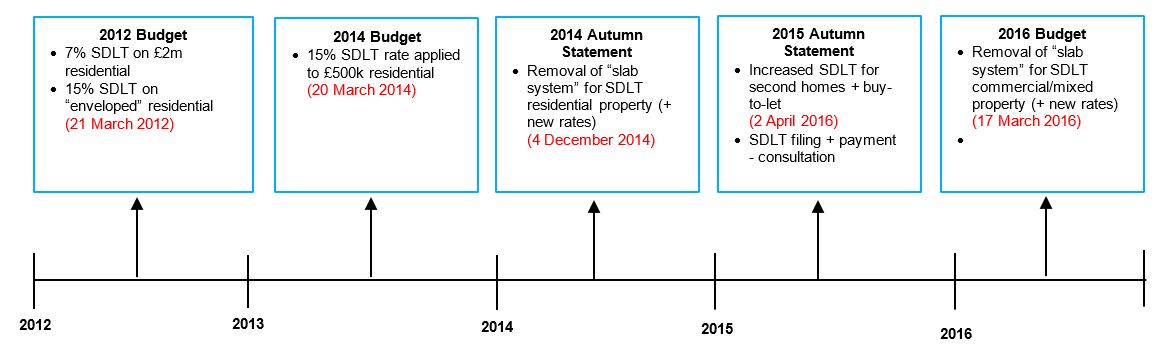

Stamp duty calculator second home. Mobile homes caravans and houseboats are exempt. You can also check out our stamp duty calculator page to see what the stamp duty would be on your main residence where the additional amount is not due. Buy to let and second homes stamp duty 2018 from april 2016 property buyers in england and wales will have to pay an additional 3 on each stamp duty band. Stamp duty for buy to let property has increased substantially from april 2016.

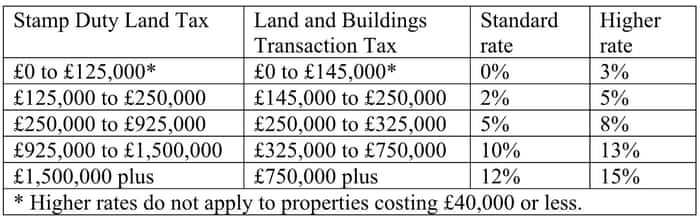

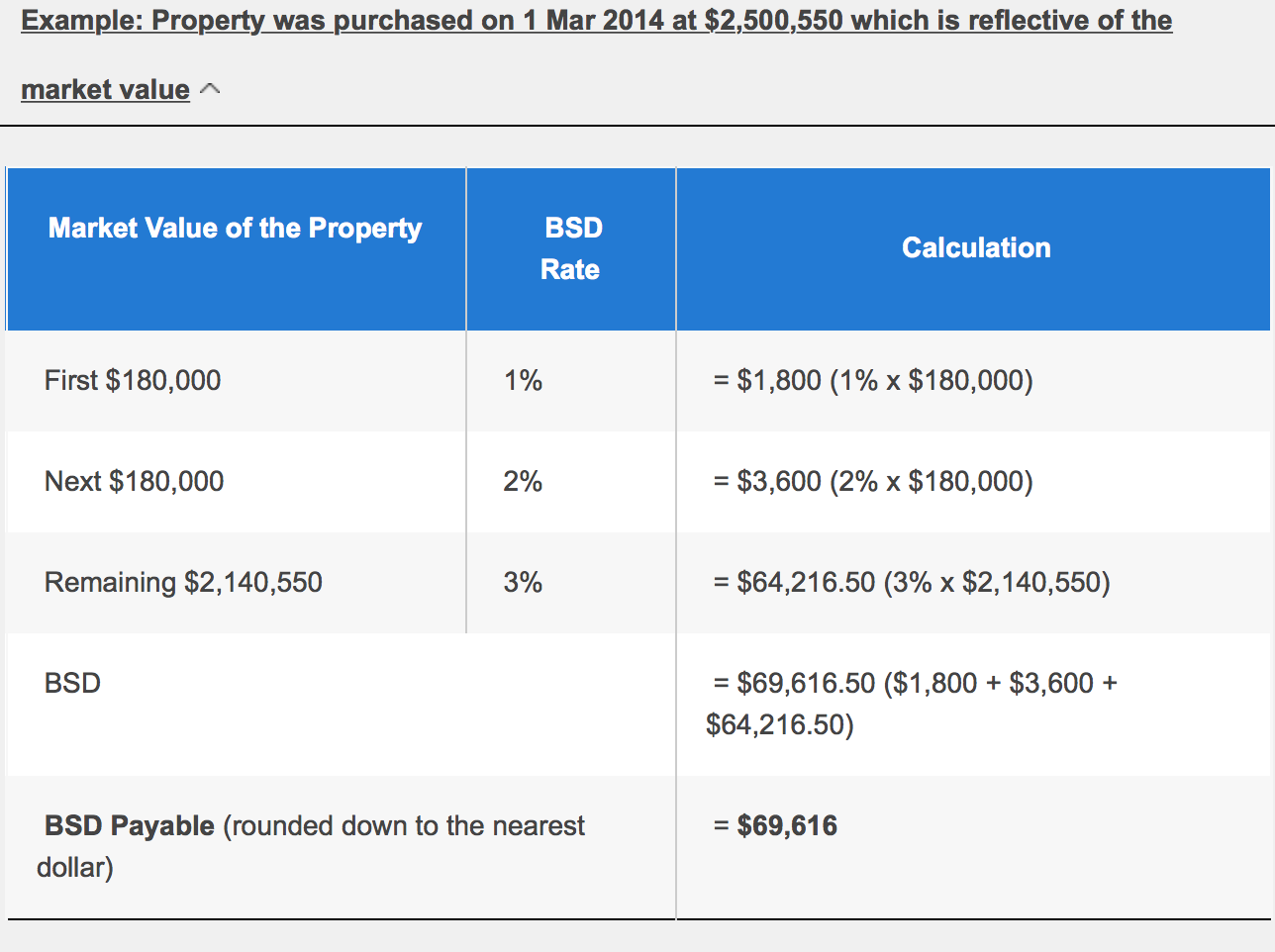

Because stamp duty is tiered see below table you will pay a different stamp duty rate on different portions of the property value. This will calculate the new rate of sdlt you will need to pay after 1st april 2016. Use our buy to let stamp duty calculator by ticking the second home or buy to let option. Stamp duty for first time buyers has been abolished for most purchasers.

Those subject to the additional rates of stamp duty rates will pay an extra 3 on top of the relevant standard rate band. It can make a huge difference in the amount of stamp duty payable particularly on higher value properties depending on whether it is classed as a main residence purchase or replacement or a second home purchase. Above that amount the usual percentage applies. For second homes or buy to let properties there will be a discount where only 3 stamp duty is payable up to the first 500 000.

In accordance with new rates introduced in 2016 people who own more than one property usually must pay 3 on top of the usual stamp duty rates. Similarly in scotland the threshold for paying land buildings transaction tax was raised from 145 000 to 250 000 on wednesday 15 july. In this case total liability for stamp duty would be 2 500 giving an effective tax rate of 0 45.