Stamp Duty Calculator Second Home Scotland

Above that amount the usual percentage applies.

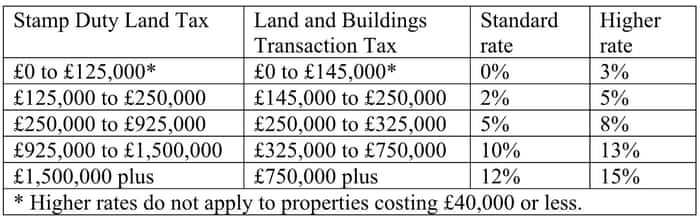

Stamp duty calculator second home scotland. Similarly in scotland the threshold for paying land buildings transaction tax was raised from 145 000 to 250 000 on wednesday 15 july. Mobile homes caravans and houseboats are exempt. For second homes or buy to let properties there will be a discount where only 3 stamp duty is payable up to the first 500 000. It can make a huge difference in the amount of stamp duty payable particularly on higher value properties depending on whether it is classed as a main residence purchase or replacement or a second home purchase.

Second properties buy to let and second homes in scotland that are purchased for 40 000 or less. Stamp duty calculator calculate the stamp duty on your residential property purchase in england or northern ireland. You can claim a discount relief if you buy your first home before 8 july 2020 or from 1 april 2021. Stamp duty for second homes also attracts a 3 percent surcharge from april.

Stamp duty for buy to let property has increased substantially from april 2016. Anyone buying an additional. 2015 s autumn statement announced a 3 additional rate of stamp duty land tax sdlt on purchases of additional properties such as buy to lets and second homes with effect from the 1st april 2016. Until april 2021 in england and northern ireland you won t pay any stamp duty on a main residence up to 500 000 while in scotland and wales the threshold s risen to 250 000.

Stamp duty for first time buyers has been abolished for most purchasers. How to work out stamp duty sdlt when buying a property in scotland for 220 000. Stamp duty for second homes also attracts a 3 percent surcharge from april. Above that amount the usual percentage applies.

Mobile homes caravans and houseboats are exempt. Stamp duty can add 10 000s to a homebuyer s costs but temporary changes mean many won t have to pay it. Stamp duty buy to let calculator on second homes. If you re buying your first home.

Until 31 march 2021 you will pay no stamp duty land tax sdlt on the purchase of your main property costing up to 500 000. For second homes or buy to let properties there will be a discount where only 3 stamp duty is payable up to the first 500 000. You pay a different tax if your property or land is in scotland or wales. I need a house purchase stamp duty calculator in scotland for 220 000.

You can also check out our stamp duty calculator page to see what the stamp duty would be on your main residence where the additional amount is not due. Stamp duty for first time buyers has been abolished for most purchasers. Similarly in scotland the threshold for paying land buildings transaction tax was raised from 145 000 to 250 000 on wednesday 15 july.

.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/shropshirestar.mna/WEDRH6XT6VHSVJG7I76HM335AI.jpg)