Stamp Duty Calculator Second Home 2020

Getty images chancellor rishi sunak announced a stamp duty holiday for anyone buying new homes up to the value of 500 000.

Stamp duty calculator second home 2020. A stamp duty holiday has been introduced until 31st march 2021. Lbtt and ltt holidays are also available in scotland and wales until 31st march 2021. Use the sdlt calculator to work out how much tax you ll pay. In accordance with new rates introduced in 2016 people who own more than one property usually must pay 3 on top of the usual stamp duty rates.

Stamp duty for buy to let property has increased substantially from april 2016. You buy a caravan mobile home or house boat. For second homes or buy to let properties there will be a discount where only 3 stamp duty is payable up to the first 500 000. The stamp duty holiday applies in part to buy to let and second home purchases but these buyers must still pay the 3 per cent surcharge at all levels including below 500 000.

To discuss which london or uk areas will provide the highest returns on investments in 2018 2019 and beyond please speak to one of our london or regional property experts who can offer. You re only exempt from the stamp duty on a second home if. Mobile homes caravans and houseboats are exempt. You can claim a discount relief if you buy your first home before 8 july 2020 or from 1 april 2021.

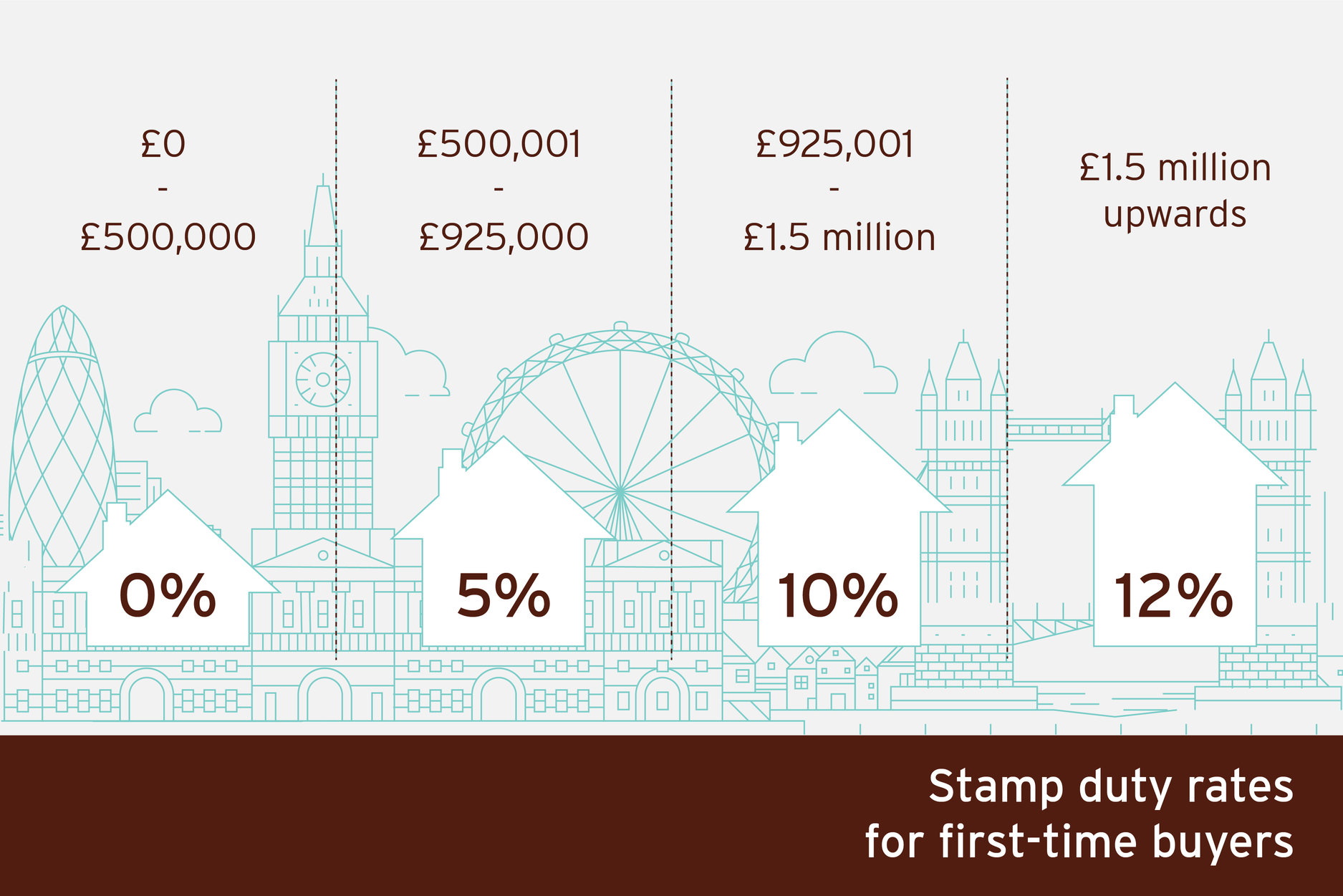

Stamp duty for first time buyers has been abolished for most purchasers. If you re buying your first home. Stamp duty for second homes also attracts a 3 percent surcharge from april 2016. Our buy to let btl stamp duty calculator for second homes and rental properties will tell you how much stamp duty you need to pay when purchasing a second home or a buy to let property.

You purchase a property valued under 40 000 or the share of the property you buy is valued under 40 000. Even if you re not exempt from paying stamp duty on a second property you can sometimes claim back the stamp duty surcharge. For those in england and northern ireland the stamp duty change kicked in on 8 july 2020 so if you exchanged before that date but completed after then you won t be required to pay stamp duty on any property worth up to 500 000. Stamp duty for buy to let property has increased substantially from april 2016.

As of 8th july 2020 the chancellor announced a stamp duty exemption for all properties in england and northern ireland up to the value of 500 000 up until the end of march 2021. The housing market could benefit from the stamp duty holiday picture. In all four home nations the key point is when you complete on your property.