Stamp Duty Calculator Second Home 2018

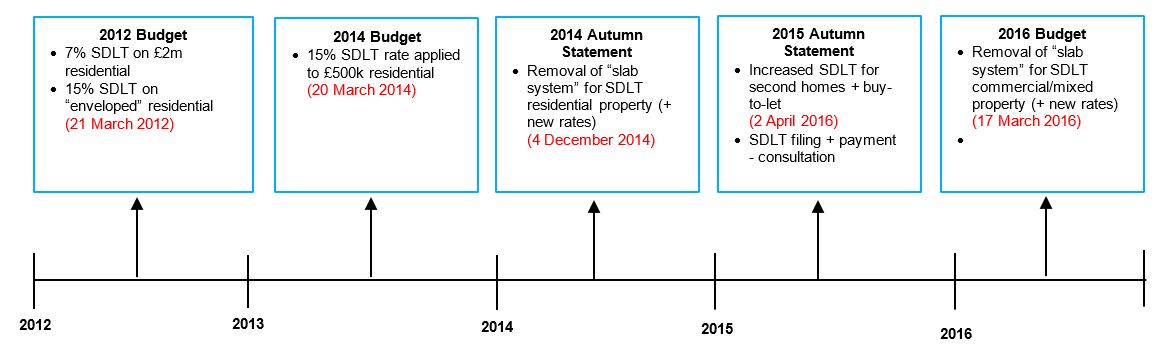

Stamp duty for buy to let property has increased substantially from april 2016.

Stamp duty calculator second home 2018. Buy to let and second homes stamp duty 2018 from april 2016 property buyers in england and wales will have to pay an additional 3 on each stamp duty band. Mobile homes caravans and houseboats are exempt. Mobile homes caravans and houseboats are exempt. A stamp duty holiday has been introduced until 31st march 2021.

In the 2018 19 tax year there were 1 036 000 property transactions with 8 370m paid in stamp duty. You can claim a discount relief if you buy your first home before 8 july 2020 or from 1 april 2021. Use the sdlt calculator to work out how much tax you ll pay. Stamp duty for buy to let property has increased substantially from april 2016.

Each quarter it releases stamp duty land tax statistics which give an indication of how many transactions are taking place and how much stamp duty is being paid. Mobile homes caravans and houseboats are exempt. Stamp duty for first time buyers has been abolished for most purchasers. Stamp duty for buy to let property has increased substantially from april 2016.

Stamp duty for buy to let property has increased substantially from april 2016. Stamp duty for second homes also attracts a 3 percent surcharge from april. Stamp duty for second homes also attracts a 3 percent surcharge from april. Because stamp duty is tiered see below table you will pay a different stamp duty rate on different portions of the property value.

Lbtt and ltt holidays are also available in scotland and wales until 31st march 2021. Stamp duty for buy to let property has increased substantially from april 2016. This will calculate the new rate of sdlt you will need to pay after 1st april 2016. Mobile homes caravans and houseboats are exempt.

Those subject to the additional rates of stamp duty rates will pay an extra 3 on top of the relevant standard rate band. Stamp duty in england and northern ireland is paid to hmrc. Stamp duty for second homes also attracts a 3 percent surcharge from april 2016. To discuss which london or uk areas will provide the highest returns on investments in 2018 2019 and beyond please speak to one of our london or regional property experts who can offer.

Stamp duty refunds are available for home movers replacing their. This is a saving of 15 000 based on the stamp duty rates that were in place prior to the 8th july 2020. Stamp duty for second homes also attracts a 3 percent surcharge from april. In this case total liability for stamp duty would be 2 500 giving an effective tax rate of 0 45.

If you re buying your first home. Stamp duty for first time buyers has been abolished for most purchasers. Stamp duty for second homes also attracts a 3 percent surcharge from april. Stamp duty for first time buyers has been abolished for most purchasers.