Second Home Tax Treatment

Use schedule d form 1040 or 1040 sr capital gains and losses and form 8949 sales and other dispositions of capital assets to report sales exchanges and other dispositions of capital assets.

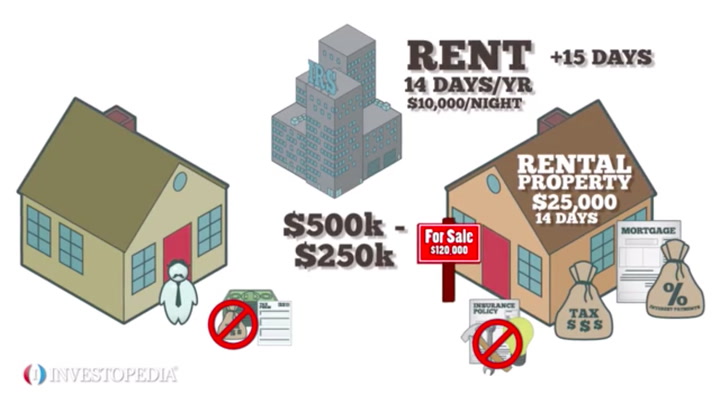

Second home tax treatment. If you use your second home as both a rental and. Before we dive into the tax implications for different types of properties it s important to understand the key differences between a second home and investment property. An example of capital gains tax on a second home. If you rented out your second home for profit gain usually is taxed as capital gain.

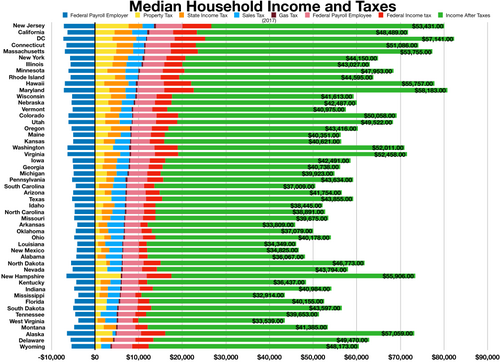

The cost of owning a second home can be reduced through tax deductions on mortgage interest property taxes and rental expenses among others. You spent 10 000 on acquisition related costs and. Second homes are particularly popular amongst older property buyers and often function as a vacation home when. When it comes to capital gains taxes the internal revenue service draws a hard line between homes used as principal residences and investment properties.

Irs explains tax treatment of state and local. Your second home such as a vacation home is considered a personal capital asset. Unfortunately this is capped at a total. Long term capital gain if you owned it for more than one year.

You can t deduct a loss on the sale. A second home and capital gain tax rules. Your second home such as a vacation home is considered a personal capital asset. Let s look at a hypothetical example.

Selling your second home. Use schedule d form 1040 or 1040 sr capital gains and losses and form 8949 sales and other dispositions of capital assets to report sales exchanges and other dispositions of capital assets. You can rent your second home out for as many as 14 days a year and pocket the income without turning it into a rental property for tax purposes. Federal tax law imposes a capital gains tax whenever you sell an asset such as your second home and earn a profit.

You bought a condo at the beach in 2012 for 250 000. A property is classified as a second home if the owner intends to occupy it on a regular basis. If you sell your second home the gain will be taxed as a.