Second Home Tax Considerations

Owning a second home the tax implications of buying and selling.

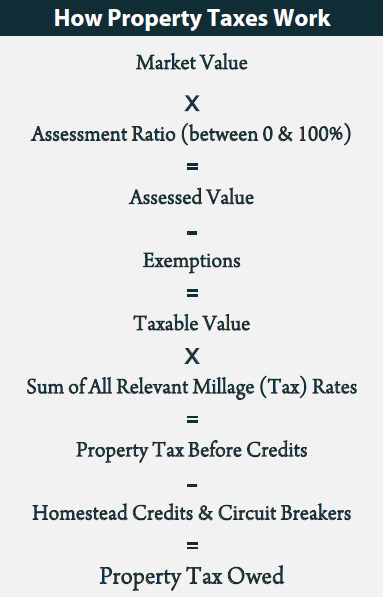

Second home tax considerations. So before getting into the taxes it s important to define the use of the second home. For capital gains tax purposes second homes include buy to let properties holiday homes land and inherited properties. You spent 10 000 on acquisition related costs and. Assessing your capital gains tax liability in the uk you pay higher rates of capital gains tax on property than on your other assets.

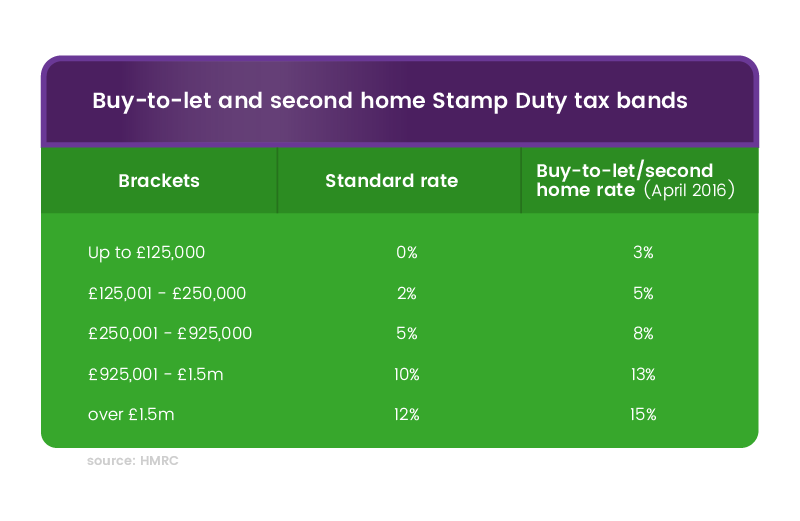

If so you can deduct the interest if you itemize. Taxpayers who buy or bought a property after that point can deduct interest for mortgage loans of up to 750 000 or. At the top end of the scale second homes worth in excess of 1 5million attract 15 per cent stamp duty rather than 12 per cent. What are the tax implications of renting out the home.

If you rent out the home you will have income tax on the net rental income but second homeowners may also qualify for various tax benefits. This applies to property which is not your main residence but an investment or holiday property. However you don t necessarily have to choose the same home as your second home each year. Basic rate taxpayers currently pay 18 on any gains they make when selling property.

To learn more see publication 936. You might take out a mortgage to buy construct or substantially improve a second home. Home mortgage interest deduction at www irs gov. But because owning any home carries a significant financial burden from mortgage and taxes to maintenance and repairs it s in your best interest to learn the tax implications for you of second.

Let s look at a hypothetical example. A second home generally offers the same tax advantages and deductions as your first home as long as you use it as a personal residence. There have been a number of changes in the last few years which have an implication on buying or selling a second property in the uk. The tax cuts and jobs act the tax reform package passed in december 2017 lowered the maximum for the mortgage interest deduction.

An example of capital gains tax on a second home. You bought a condo at the beach in 2012 for 250 000. If you re considering buying a second home there are a number of financial considerations including purchase price carrying expenses and tax issues. The amount of time spent residing in the home will directly impact the taxes that you pay.

Second homes for the purposes of the stamp duty surcharge are homes other than a main residence whether they are let or not.