Second Home Insurance Rates

For example you ll need to make sure your new home has the right amount of insurance coverage in case disaster strikes.

Second home insurance rates. If your second home is empty for an extended period it can be more vulnerable to damage. Insurance for your second home has all the same coverages as your primary home but insurance costs are going to differ because the risks that determine your rates are slightly different for second homes. Second home insurance can be a costly addition to your getaway plans. But there are unique risks involved with insuring a second home.

On average an annual policy for your second home could cost. Odds are your first home is covered by a standard homeowners policy otherwise known as a ho 3 policy. Secondary home insurance one of the key differences between a first and second home insurance policy is what coverage is offered. You may be able to save a little bit of money on your second home s insurance policy in a few ways.

The cost of most improvements to a second home will generally outweigh what you save on your premium though they can make your insurance rates less expensive. If you own a second home you ll know that you simply can t be there to protect your property all of the time which can leave your house susceptible to risks. If you re going to offer your second home as a rental you ll most likely need additional coverage like landlord insurance. Whether your second home is a seaside bungalow or a cabin in the woods you re going to need homeowners insurance to protect the home and your personal belongings.

Is second home insurance more expensive. That s why it s important to have as much detailed information as possible when planning the home insurance basics for your budget. Also second home insurance can cost more than the insurance at your primary home. The cost of second home insurance varies based on factors that include how you and your family use your second home how regularly the home is used and the level of cover you need.

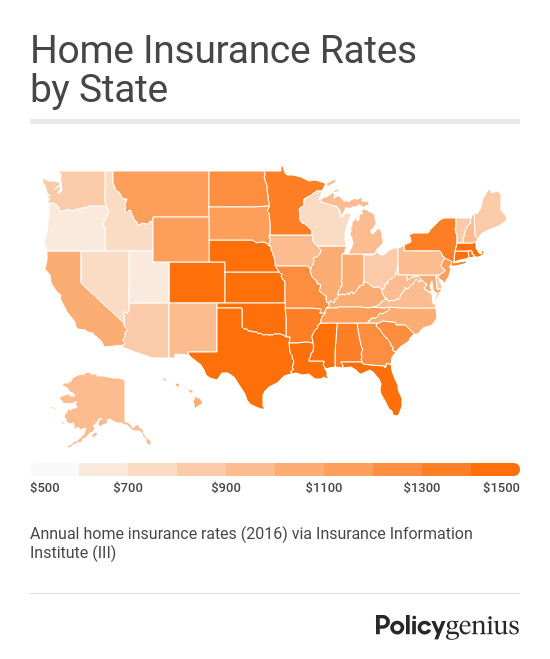

And you want to be sure you buy enough protection to fully protect your home so it s wise to seek guidance to prevent your. Average home insurance rates can vary a lot depending on where you live your deductible amount and the amount of coverage you need. Your insurance rate may be higher if your second home is far from emergency services. Holiday home 265 30 unoccupied property 204 19.

For example policyholders get a discount for homes with a central alarm system but the savings on your premium is far less than the subscription fee for eligible systems. Primary home insurance coverage vs. Read on to learn more about the ways your second home insurance coverage will differ from your first home s coverage plan. Second home insurance is a policy which will cover a property that is not your main residence.