Second Home Insurance Cost

On average an annual policy for your second home could cost.

Second home insurance cost. You may also want to talk with your insurance agent to find out if there are any other insurance protections for your second home that you may want to consider. Whether your second home is a seaside bungalow or a cabin in the woods you re going to need homeowners insurance to protect the home and your personal belongings. How much does uk second home insurance cost. A personal umbrella policy would help cover these additional costs beyond your homeowners insurance coverage.

Your first home is typically worth more than your second home making insurance for your first home more expensive. For example you ll need to make sure your new home has the right amount of insurance coverage in case disaster strikes. You d be responsible for coming up with the extra 500 000. The cost of second home insurance can vary a lot.

Insurance for your second home has all the same coverages as your primary home but insurance costs are going to differ because the risks that determine your rates are slightly different for second homes. Second home insurance cost no matter what the policy you should expect to pay more for a seasonal home insurance policy than your primary home. Second home insurance is a policy which will cover a property that is not your main residence. For example if you have been a policyholder with state farm for less than 2 years and have one paid claim your premium will increase 15.

Remaining claim free is vital to keeping the cost of your second home insurance premium down. The cost of second home insurance varies based on factors that include how you and your family use your second home how regularly the home is used and the level of cover you need. Buying a second home either as a vacation getaway or a rental property is a lot like purchasing a primary residence. But there are unique risks involved with insuring a second home.

If you have two claims within a three year period it will go up 35. When it comes to the cost of insuring your second home it depends on several factors the type of property e g. Nationwide applies a 20 percent increase for second homes but state farm only ups premiums by 10 percent. A good second home insurance policy will provide complete financial aid to fully rebuild your house including demolition clearing the site and paying for architects.

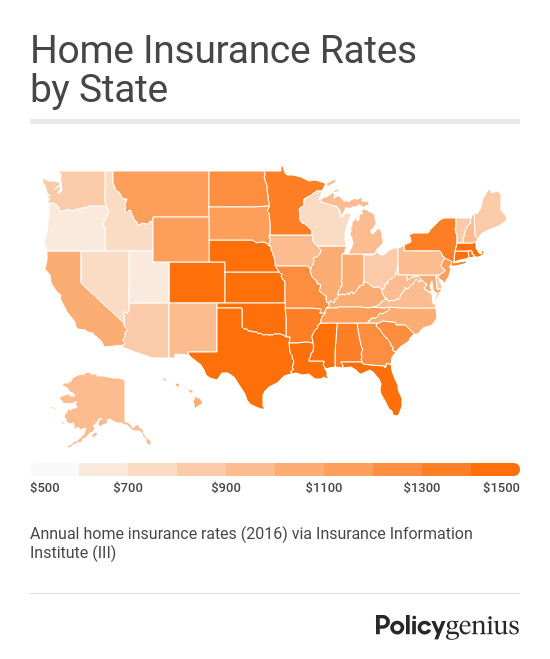

But your first home may be located in a safer area that provides discounts whereas a second home could be in a rural area more prone to natural disasters or fire. If you own a second home you ll know that you simply can t be there to protect your property all of the time which can leave your house susceptible to risks.