Home Reversion Plan Vs Lifetime Mortgage

Think of a lifetime mortgage as a long term loan which is secured against your property.

Home reversion plan vs lifetime mortgage. Home reversion plans and lifetime mortgage allow you to release cash locked in your home to fund your retirement. The former sells a share of your home whereas a lifetime mortgage is a loan secured against your property. Home reversion plan vs lifetime mortgage. Once you ve established whether equity release is right for you your choice between different equity release schemes typically comes down to either a home reversion plan or a lifetime mortgage.

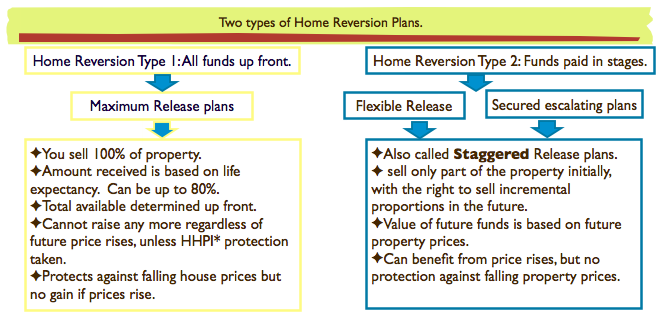

With a home reversion scheme the proportion of the property you sell to the provider doesn t change over time. Find out more in our guide. Interest does need to be paid on the loan but it s not like a standard mortgage there s no set term and you don t need to make any monthly repayments unless you opt for an interest only lifetime mortgage in which case. Home reversion is far less popular than lifetime mortgages.

For a home reversion plan you must be at least 60 years old. Investment company will buy or arrange for someone to buy part or all of a. The chart below shows how this works. While a lifetime mortgage means taking a loan against the equity in your home a home reversion scheme involves selling all or part of your home to a.

Each has pros and cons. The other is a lifetime mortgage. Instead the loan and accumulated interest is paid in full from the sale of your property when you move in to long term care or die. They could have major implications for tax benefits inheritance and your long term financial planning.

However with a lifetime mortgage from an equity release council approved member you ll receive the no negative equity guarantee. Client continues to own the home completely and retains the right to live in it. This has some obvious benefits both psychological and practical so why might you choose home reversion instead. Home reversion plans are high risk products.

Home reversion plan or lifetime mortgage. You should always get independent financial advice before taking out a home reversion plan or any other kind of equity release scheme. The crucial difference between home reversion and lifetime mortgage is that with a lifetime mortgage borrowers still own 100 of their property. With a lifetime mortgage you borrow a percentage of the value of your property.