Home Reversion Plan Vs Equity Release

Tighter regulation has led to fairer deals for customers in recent years however and everyone s situation is different so we still get a few queries from homeowners looking to explore this type of equity release in later life.

Home reversion plan vs equity release. Once you ve established whether equity release is right for you your choice between different equity release schemes typically comes down to either a home reversion plan or a lifetime mortgage. Home reversion plans are high risk products. One type of equity release is a home reversion loan. Home reversion plans are high risk products.

You should always get financial advice before taking out a home reversion plan or any other kind of equity release scheme. I f you are considering equity release to unlock some of your property wealth think carefully about the type of product you choose a home reversion plan for example can be a good option for a. If you enter into a home reversion plan you agree to sell some or all of your house to an equity release provider for less than the market value this is typically 20 to 60 of what the home is worth on the open market depending on your age and state of heath. How does a home reversion plan compare to a lifetime mortgage.

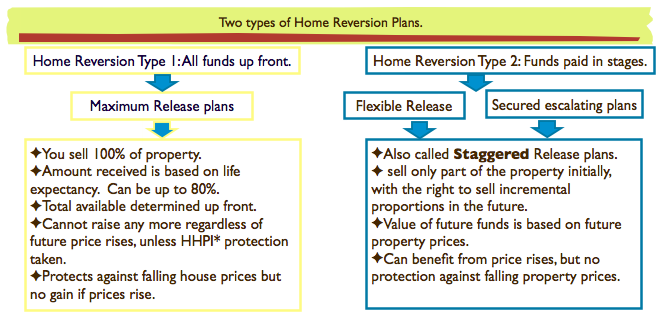

Explains how it works and the risks to watch out for. In this expert guide we explain how it works and the risks to. These are home reversion plans which allow you to sell part or all your property in exchange for a cash lump sum. One type of equity release is a home reversion loan.

You should always get independent financial advice before taking out a home reversion plan or any other kind of equity release scheme. A home reversion plan sees you selling a stake in your property in return for a cash lump sum. Home reversion plan or lifetime mortgage. A lifetime mortgage is essentially a loan secured against your home that allows you to release equity from your property.

To understand their features benefits and risks please contact equity release supermarket for a personalised key facts illustration. While a lifetime mortgage means taking a loan against the equity in your home a home reversion scheme involves selling all or part of your home to a. A lifetime tenancy is then created protecting the homeowners residency and freedom to live in their home rent free for the rest of their life. They could have major implications for tax benefits inheritance and your long term financial planning.

The original equity release schemes home reversion plans have now been almost entirely superseded by more flexible lifetime mortgages. They could have major implications for tax benefits inheritance and your long term financial planning. There are a few primary differences between the two main types of equity release schemes the lifetime mortgage and the home reversion plan.