Holiday Home Mortgage Deposit

This protects the bank s money in the event that the buyer fails to repay because they can be confident of reclaiming their loan through repossession.

Holiday home mortgage deposit. When purchasing a property with the aid of a holiday let mortgage you will need to provide a cash deposit of at least 25. You ll need a reasonable deposit when applying for a holiday home mortgage. Oh and you can t be buying for investment only holiday homes or buying with an intention to move home will qualify. Buying property to use as a holiday rental home can be a worthy investment but there are plenty of facts worth knowing before getting a mortgage for holiday lets.

The source of the deposit is an important consideration that is often overlooked by many purchasers. Typically expect to pay a minimum deposit of 25 to 30 while interest rates and fees tend to be only slightly higher than mainstream residential mortgages. That s because there is more risk to the lenders of a holiday let than with a normal mortgage or buy to let where the tenants will be longer term. So up to 85 ltv loan to value with affordability based on personal earned income with deductions for expenditure including existing mortgages that are not fully.

Maximum loan to value ltv. Put simply you need a big deposit big income clean credit and you probably need to be an irish citizen or have some strong connection to the country. Compare mortgages with uswitch. If you do have the deposit and you can service the mortgage you can buy a bach on an interest only loan.

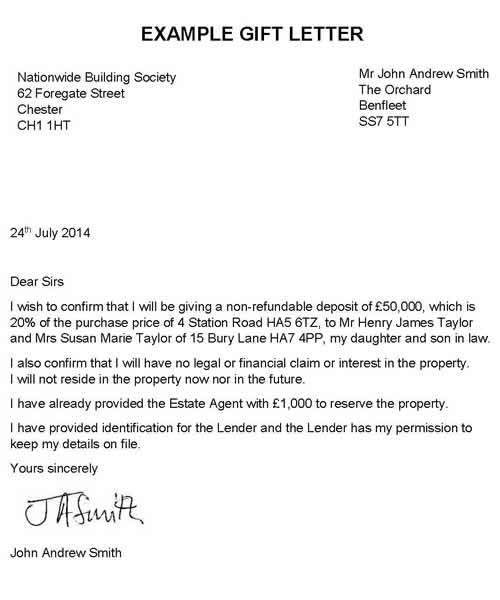

Deposits can come from. Deposits for holiday let mortgages. In order to get the best french mortgage interest rates and to secure against unforeseen currency exchange downturns french mortgage providers may ask non residents to open a savings account with a minimum deposit equal to at least 24 mortgage payments. To be very honest getting a mortgage in the republic of ireland is not easy.

In order to get a holiday let mortgage you ll need to be able to provide at least a 30 deposit. Because of this additional exposure to risk mortgage providers usually want to see a much larger deposit of 25 30 from holiday home buyers. Bolton says most of his clients who buy holiday houses are aucklanders with high incomes and houses with very high home equity levels who can service debt levels of up to 800 000.