Go Compare Home Insurance Landlords

It includes one or more of.

Go compare home insurance landlords. Compare quotes from 70 home insurance providers. We ve compiled this home insurance provider hub to help you compare uk home insurance providers individual policies to make sure you can find the policy that s right for you. It s sometimes packaged up with your bank account or as an add on with your home insurance so check before you take out stand alone cover. As a landlord a standard home insurance may not provide enough cover so that s where landlords insurance comes in handy.

We re committed to comparing home insurance to help you find the right deal for you. It s your landlord s responsibility to look out for you if there s a home emergency. Buy to let insurance if you own a buy to let property you ll need specialist landlord insurance. Just like with home insurance landlords can add it to their cover or buy a specialist.

Home insurance business insurance landlord insurance. Landlord home emergency cover. Read more about your responsibilities as a landlord in our guide. Liability insurance this feature of a buy to let insurance policy protects landlords from being sued by a tenant for any accidents at the property resulting in injury or death.

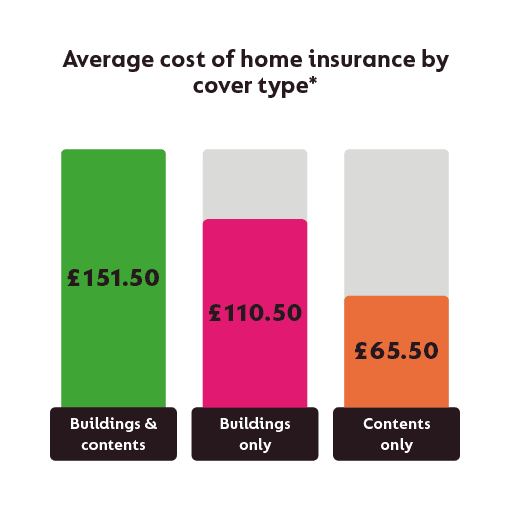

And if you re renting out a furnished property it s worth considering contents insurance as this can protect everything from your. Correct as of may 2020. We work with over 65 providers to find you some of the best deal on your home insurance. 51 could save up to 102 63 with us on their buildings and contents insurance consumer intelligence research conducted between 1 feb 2020 to 29 feb 2020.

That s why we work with over 65 brands to bring you the pick of the deals. Also known as buy to let insurance it typically includes buildings insurance to cover against events such as fire flooding and subsidence. Find out more rent guarantee insurance. Our guides give you the facts so you can make an informed choice when you compare landlord insurance policies and providers.

Loss of rent of up to 2500 a month can be covered by rent. Buildings insurance covering damage to the structure of the building and built in features such as fitted kitchens. Tenants don t need it. We compare 74 of the uk s home insurance providers to help you get the best possible quote.