First Time Home Buyer Uk Stamp Duty

Check out our guide on stamp duty for first time buyers.

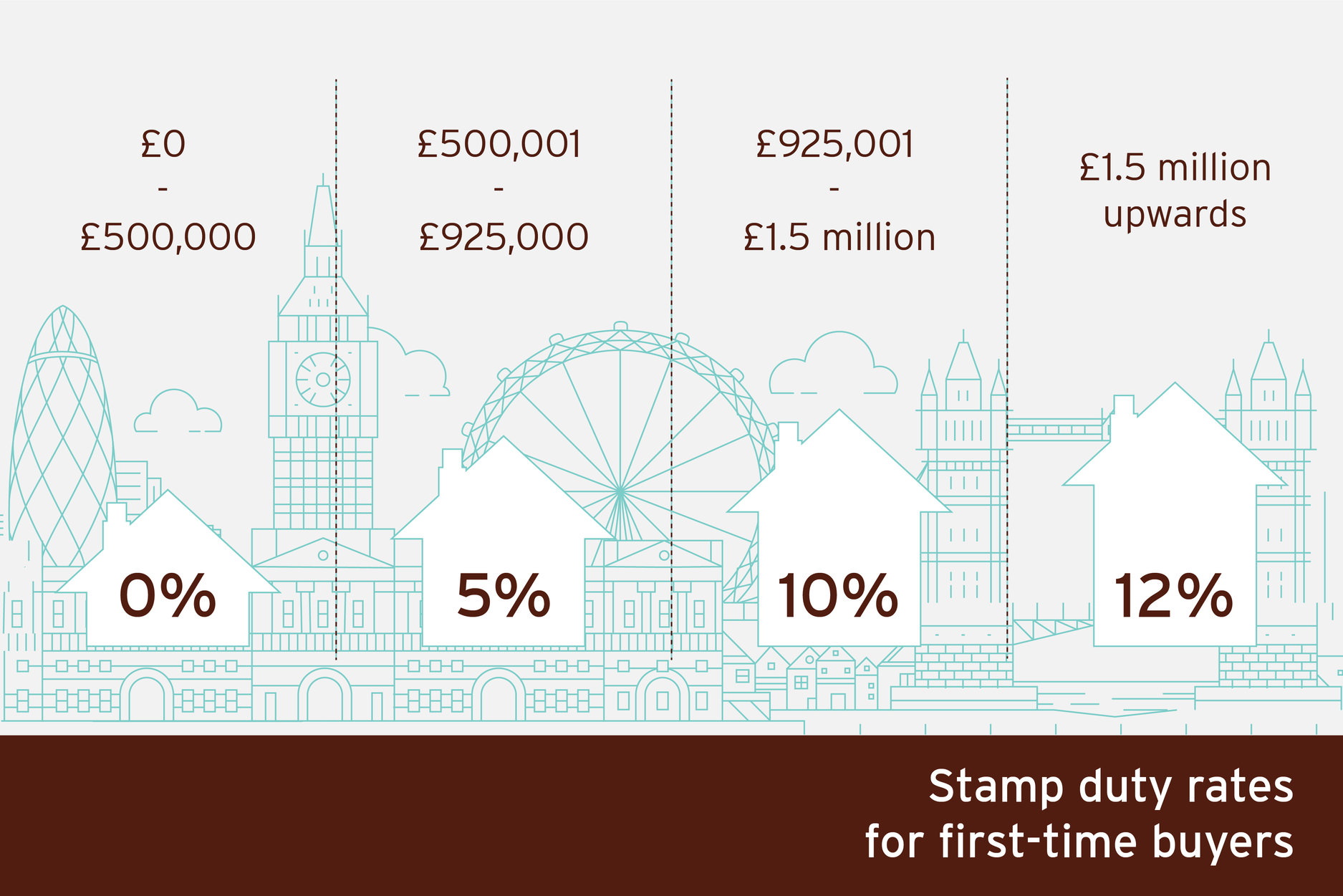

First time home buyer uk stamp duty. The rules for first time buyers are different which means that there are different rates of stamp duty on second homes. You pay zero stamp duty on the first 300 000. With almost 800 agents across the uk you are never far from a guild member. You don t have to pay stamp duty on homes that cost up to 300 000 and are exempt on paying some stamp duty for homes that cost up to 500 000.

The 300 000 threshold meant the vast majority of first time buyers were already exempt from the tax with the average price paid for a first home in england standing at 208 000. A special first time buyer code could then be submitted with the stamp duty return once a home was purchased. First time buyers paying between 300 000 and 500 000 will. First time buyers relief.

Yes to an extent. First time buyers needed to declare that they had never owned a property either in the uk or abroad. If you re a first time buyer in england or northern ireland you are eligible for stamp duty relief for properties worth up to 500 000. From 22 november 2017 first time buyers paying 300 000 or less for a residential property will pay no stamp duty land tax sdlt.

Buying your first home. How will it affect buying a second home and. Savings for the few. Full stamp duty relief was available up to 300 000 with reduced liability up to 500 000.

If a first time buyer bought a property for 500 000 they d save 10 000 in stamp duty peter gettins of mortgage broker l c mortgages told the sun. Use the sdlt calculator to work out how much tax you ll pay. Check out our guide on stamp duty for first time buyers. From 8 july 2020 to 31 march 2021 the special rules for first time buyers are replaced by the reduced rates set out above.

Confused about stamp duty and how much to pay. A buy to let investor purchasing an average priced home in barking and dagenham would save nearly four times the amount in stamp duty than a first time buyer a total of 4 130. Are first time home buyers exempt from buying stamp duty. Until 31 march next year first time buyers in england and northern ireland only need to pay stamp duty on properties costing more than 500 000 rather than 300 000.

.jpeg)