Capital Gains Tax On Second Home Abroad

Capital gains tax on second homes will be affected by new rules which come into force in april 2020 also impacting on second home owners and property investors.

Capital gains tax on second home abroad. Certain periods of absence from living in the property can be deemed to be periods of occupation or residence making the owner eligible for full relief from capital gains tax. When it comes to selling real estate abroad the main us tax consideration for expats is capital gains tax. If you have a second home abroad then although it may be nominated as a main home and a reduction possibly. Taxpayers have until august 9 to inform hmrc about any unpaid tax on such property sales and until september 6 to pay the tax that they owe.

Capital gains tax when you sell a property that s not your home. Work out your gain and pay your tax on buy to let business agricultural and inherited properties. Expats selling property abroad that they have lived in for at least two out of the last five years can exempt the first 250 000 or 500 000 if they re married of the increase in the property s value since they bought it from us capital gains tax liability. If the property was sold during the 2019 20 tax year you won t need to pay capital gains tax for the time it was your main residence plus the past 18 months of ownership even if you weren t living in the property during those 18 months.

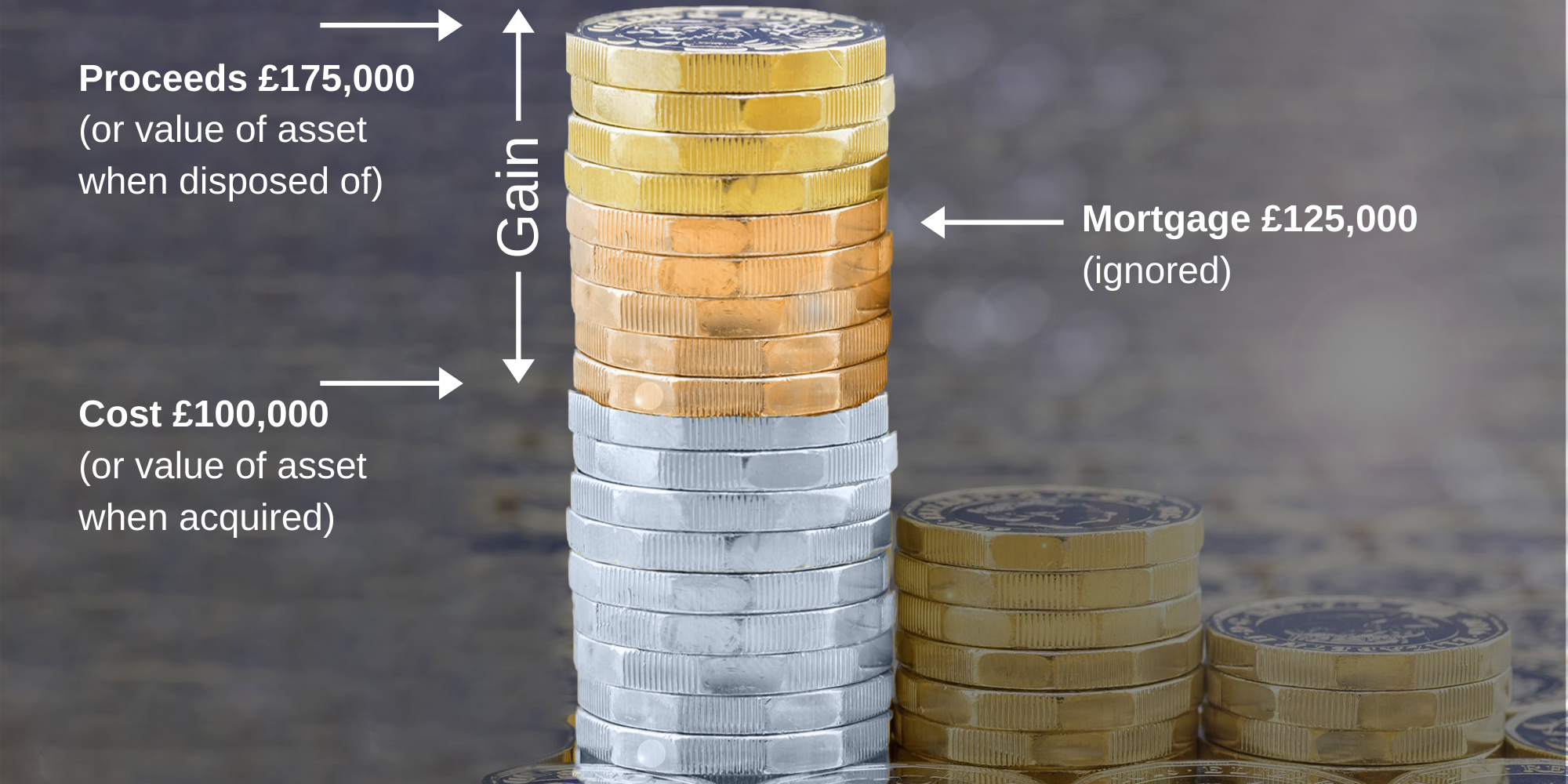

Hmrc s property sales campaign targets those selling second homes in the uk or abroad where capital gains tax cgt should be paid. Currently if as a uk resident you sell a property where capital gains tax cgt is due you have to pay this by january 31 after the end of the tax year in which the gain arose. Selling real estate abroad. This also includes properties that were rented out and holiday homes.

Question we are an. If you lived in the home for at least two of the last five years it qualifies as your primary residence and you can exclude up to 250 000 of capital gains or up to 500 000 for married. From sale or gift. Work out your gain and pay your tax on buy to let business agricultural and inherited properties.

For the former capital gains tax on property is 18 whereas for the latter it comes in at 28. For property sales during 2020 21 this 18 months is reduced to nine months.